UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ | Filed by a party other than the Registrant ☐ |

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material |

FIRST AMERICAN FINANCIAL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

☒ | No fee required |

|

|

|

|

|

|

|

|

|

|

|

|

☐ | Fee paid previously with preliminary materials. |

☐ |

|

|

|

|

|

|

|

|

|

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT First American Financial Corporation

2020 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT FIRST AMERICAN First American Financial Corporation

March 30, 2018April 1, 2022

Dear Fellow Stockholder,

You are cordially invited to attend our annual meeting of stockholders at 1 p.m.1:00 PM Pacific time, on May 8, 2018,10, 2022. This year’s annual meeting of stockholders will be held in a virtual-only meeting format online via live webcast using a unique link to be provided by email after registering at the executive offices of First American Financial Corporation, located at 1 First American Way, Santa Ana, California 92707.register.proxypush.com/FAF.

With this letter, we are including the notice for the annual meeting, the proxy statement and the proxy card. We are also including a copy of our 20172021 annual report. A mapMore information regarding how to vote, participate in, and directions to our executive officessubmit questions for the annual meeting can be found on the inside back cover ofin the proxy statement.

We have made arrangements for you to vote your proxy over the Internet or by telephone, as well as by mail with the traditional proxy card. The proxy card contains instructions on these methods of voting.

Your vote is important. Whether or not you plan on attendingparticipating in the virtual annual meeting on May 8, 2018,10, 2022, we hope you will vote as soon as possible.

Thank you for your continued support of First American Financial Corporation.

|

|

Dennis J. Gilmore Chairman of the Board |

Chief Executive Officer |

First American Financial Corporation | NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

To be Held on May 8, 2018

The annual meeting of stockholders of First American Financial Corporation, a Delaware corporation (our “Company”), will be held at 1 p.m. Pacific time on May 8, 2018, at the executive offices of the Company, located at 1 First American Way, Santa Ana, California 92707, for the following purposes:

| Date | Matters to be voted on | ||||

May 10, 2022 | Proposal | Board Recommendation | ||||

| Time | |||||

|

|

| Election of the three persons named in the accompanying proxy statement to serve as Class | Vote For | ||

1:00 PM Pacific Time | ||||||

| Website | |||||

2 | Approval, on an advisory basis, of our Company’s executive compensation. |

Vote For | ||||

register.proxypush.com/FAF | ||||||

|

|

|

Vote For | |||

|

|

| ||||

Who can vote Only stockholders of record at the close of business on March 17, 2022 are entitled to notice of the meeting and an opportunity to vote. | 4 | Ratification of the selection of PricewaterhouseCoopers LLP as |

Vote For | |||

|

|

| ||

At the meeting, we will also transact such other business as may properly come before the meeting or any postponements or adjournments thereof. | ||||

OnlyThis year’s meeting will be held in a virtual-only meeting format online via live webcast. To participate in the meeting, stockholders must go to register.proxypush.com/FAF with the control number provided on their proxy card or voting instruction form and register by following the instructions. Upon completing registration, a stockholder will receive further instructions via email, including a unique link that will allow that stockholder access to the meeting. During the meeting, stockholders may vote, submit questions and view the list of record at the close of business on March 15, 2018 are entitled to noticestockholders as of the record date. For additional information on voting at or participating in the meeting online, including how to submit questions, please see “Questions and an opportunityAnswers” on page 74.

How to vote.vote your shares before the meeting

Your vote is very important. Please submit your vote by proxy as soon as possible via the Internet, telephone or mail.

| VIA THE INTERNET Visit the website listed on your proxy card, notice or voting instruction form. |

| BY PHONE Call the phone number listed on your proxy card or voting instruction form. | Y |

| BY MAIL Complete, sign, date and return your proxy card or voting instruction form in the envelope provided. |

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 8, 2018:10, 2022: First American Financial Corporation’s notice of annual meeting and proxy statement, annual report and other proxy materials are available at www.firstam.com/proxymaterials.proxymaterials.

We hope you will attend

Notice of Annual Meeting of Stockholders |

In the event of a technical malfunction or other situation that the meeting chair determines may affect the ability of the meeting to vote in person. However, if you are unablesatisfy the requirements for a meeting of stockholders to attendbe held by means of remote communication under the Delaware General Corporation Law, or that otherwise makes it advisable to adjourn the meeting, and vote in person, please submit a proxy as soon as possible, so that your shares can be voted atthe chair of the meeting in accordance with your instructions. You may submit your proxy (1) overwill convene the Internet, (2)meeting at 2:00 PM Pacific Time on the date specified above and at our address, 1 First American Way, Santa Ana, CA 92707, solely for the purpose of adjourning the meeting to reconvene at a date, time and physical or virtual location announced by telephone, or (3) by mail. For specific instructions, please refer to the questions and answers commencing on page 61meeting chair. Under either of the proxy statement andforegoing circumstances, we will post information regarding the instructionsannouncement on the proxy card.Investors page of our website at investors.firstam.com.

Jeffrey S. RobinsonGreg L. Smith

Vice President, Deputy General Counsel and Secretary

Santa Ana, California

March 30, 2018April 1, 2022

|

| Page | |||

|

|

| |||

| 1 | ||||

|

|

| |||

I. |

| 2 | |||

|

|

| |||

| |||||

|

| ||||

| 7 | ||||

|

|

| |||

| |||||

|

|

| |||

|

|

| |||

|

|

| 10 | ||

|

|

| |||

| 16 | ||||

II. | 17 | ||||

|

|

| |||

|

|

| |||

| |||||

|

|

| |||

|

|

| |||

|

|

| |||

|

|

| |||

| |||||

| Board Leadership Structure; Meetings of Independent Directors |

|

| ||

|

|

| |||

|

|

| |||

|

|

| |||

| 22 | ||||

|

|

| |||

|

|

| |||

| |||||

| Stockholder and Interested Party Communications with Directors |

|

| ||

|

|

| |||

|

| ||||

| |||||

| |||||

| |||||

| |||||

| |||||

| 23 | ||||

|

|

| |||

|

|

| |||

|

|

| |||

|

| 26 | |||

|

|

| |||

| |||||

| |||||

|

|

| |||

|

|

|

| ||

|

|

| |||

| |||||

| |||||

| |||||

| |||||

| |||||

First American Financial Corporation 2018 Proxy Statement | i

First American Financial Corporation 2022 Proxy Statement | i

Page | ||||

| ||||

| ||||

58 | ||||

59 | ||||

59 | ||||

60 | ||||

61 | ||||

66 | ||||

67 | ||||

69 | ||||

69 | ||||

69 | ||||

69 | ||||

Securities Authorized for Issuance under Equity Compensation Plans | 70 | |||

70 | ||||

| Relationship with Independent Registered Public Accounting Firm |

|

| |

|

|

|

| |

|

|

| ||

|

|

|

| |

|

|

| ||

|

|

|

| |

| Stockholder Proposals, Director Nominations and Proxy Access |

|

| |

|

|

|

| |

|

|

| ||

|

|

|

| |

III. |

|

| ||

|

|

|

| |

IV. |

|

| ||

|

|

|

| |

V. |

|

| ||

|

|

|

| |

| A-1 | |||

|

|

|

| |

APPENDIX B Amended and Restated 2010 Employee Stock Purchase Plan |

| B-1 | ||

ii | 20182022 Proxy Statement First American Financial Corporation

First American Financial Corporation

Solicitation of Proxies by the Board of Directors

OurThe board of directors (our “Board”) of First American Financial Corporation, a Delaware corporation (our “Company,” “we” or equivalent terms), is soliciting proxies from holders of our common stock for use at the annual meeting of our stockholders to be held on May 8, 2018,10, 2022, at 1 p.m.1:00 PM Pacific time. The meeting will be held in a virtual-only meeting format online via live webcast using a unique link to be provided by email after registering at the executive offices of First American Financial Corporation, a Delaware corporation (our “Company” or “First American”), located at 1 First American Way, Santa Ana, California 92707.register.proxypush.com/FAF. We have included a mapinformation on how to vote, submit questions, and directions to our executive officesparticipate in the virtual meeting in the “Questions and Answers” section on the inside back cover of the proxy statement for your convenience.pages 75 and 77.

We are mailing this proxy statement and the enclosed proxy card, notice of annual meeting, stockholders letter and 20172021 annual report to our stockholders on or about March 30, 2018.April 1, 2022. In lieu of a proxy card, holders of shares held in street name through a bank, broker or other nominee are receiving a voting instruction form from their bank, broker or other nominee. As used herein, references to “proxy” or “proxy card” also refer to the voting instruction form provided to street name holders.

The remainder of this proxy statement has been divided into five sections. You should read all five sections.sections before you vote.

| I. | Proposals: this section provides information relating to the proposals to be voted on at the stockholders’ meeting. |

| II. | Required Information: this section contains information that is required by law to be included in this proxy statement and which has not been included in the other sections. |

| III. | Corporate Responsibility and Sustainability: this section highlights some of our efforts to reduce our environmental impact and to improve the communities in which we operate. |

| IV. | Questions and Answers: this section provides answers to a number of frequently asked |

| V. | Other Information: this section provides other information regarding this proxy, including instructions about how to obtain a copy of our annual report. |

The Compensation Discussion and Analysis section contains certain financial measures that are not presented in accordance with generally accepted accounting principles (“GAAP”), including adjusted return on average total equity and adjusted pretax margin. Please see Appendix A for the rationale behind the presentation of these measures and a reconciliation of these amounts to the nearest GAAP financial measures.

First American Financial Corporation 20182022 Proxy Statement | 1

I. Proposals |

Information Regarding the Nominees for Election

The following list provides information with respect to each personthe three persons nominated and recommended to be elected as a Class IIIII director by our Board, to serve for a three-year term expiring on the date of the 20212025 annual meeting of stockholders. Each of the nominees is currently serving as a director of the Company. Virginia M. Ueberroth will retire in connection with the annual meeting. Theour Company has been conducting a search for a director to fill the vacancy createdand was previously elected by Ms. Ueberroth’s retirement, and it is anticipated that an appointment will be made to fill that vacancy shortly following the annual meeting, assuming the clearing process has been satisfactorily completed.

|

| ||

|

| ||

2 | 2018 Proxy Statement First American Financial Corporation

|

Information Regarding the Other Incumbent Directors

The following lists provide information with respect to the individuals currently serving as Class III directors, whose current term expiresstockholders at the 2019 annual meeting of stockholders, and Class I directors, whose term expires in 2020, followed by similar information for a retiring director.

Class III Directors—Term Expiring 2019stockholders.

|

|

|

|

|

Age:

|

| |

|

| ||

First American Financial Corporation 2018 Proxy Statement | 3

|

2 | 2022 Proxy Statement First American Financial Corporation

I. Proposals |

Age: 67 Director since: 2013 Committees: Audit Compensation Independent: Yes | MARK C. OMAN Mr. Oman retired from Wells Fargo & Company in 2011, after serving it or its predecessors since 1979. He held numerous positions at Wells Fargo, including senior executive vice president (home and consumer finance) from 2005 until his retirement and group executive vice president (home and consumer finance) from 2002 to 2005. Mr. Oman also served as a director and the chief executive officer of Wachovia Preferred Funding Corp. from 2009 to 2011 and as a director of American Caresource Holdings, Inc. from 2013 to 2017. He is currently involved with several private ventures and serves on a variety of private-company and non-profit boards. Mr. Oman brings to the Board important insights into the mortgage market and working with large mortgage lenders. | ||

Information Regarding the Other Incumbent Directors

The following lists provide information with respect to the individuals currently serving as Class I directors, whose current term expires at the 2023 annual meeting of stockholders, and Class II directors, whose term expires in 2024. The Class I directors were previously elected by stockholders at the 2020 annual meeting (other than Mr. DeGiorgio who was appointed in 2022), and the Class II directors were previously elected by stockholders at the 2021 annual meeting.

Class I Directors—Term Expiring 20202023

First American Financial Corporation 2022 Proxy Statement | 3

4 | 2018 Proxy Statement First American Financial Corporation

|

|

|

|

|

|

Age: Director since: 2011 Committees: Audit Executive Independent: Yes |

| THOMAS V. MCKERNAN

Mr. McKernan |

| |||

|

| ||

|

|

|

|

|

|

|

|

Directors Serving through May 8, 2018

4 | 2022 Proxy Statement First American Financial Corporation

I. Proposals |

Class II Directors—Term Expiring 2024

First American Financial Corporation 2022 Proxy Statement | 5

Age: 64 Director since: 2018 Committees: Governance Independent: Yes | MARTHA B. WYRSCH Ms. Wyrsch retired in 2019 as executive vice president and general counsel for Sempra Energy, a leading energy services company, where she oversaw the company’s legal affairs and compliance initiatives. Prior to joining Sempra Energy in 2013, Ms. Wyrsch served as the president of Vestas American Wind Technology from 2009 to 2012, where she had direct responsibility for all North American sales, construction, service and maintenance. In addition to her executive leadership roles, she served as a member of the board of directors of Spectra Energy Corporation and SPX Corporation. She currently serves on the board of directors of Quanta Services, Inc. (NYSE: PWR), a specialized contracting services company and National Grid plc (FTSE:NG; NYSE:NGG), an investor-owned utility managing electric and natural gas assets in the United Kingdom and United States. From 2012 to 2021 she also served as a director of Spectris plc, a publicly traded company listed on the London Stock Exchange and from 2019 to 2020 as a director of Noble Energy, Inc. (NYSE: NBL), an energy exploration and production company. As an accomplished director for publicly-traded companies, and with deep experience leading intricate businesses, Ms. Wyrsch provides valuable insight into how we can enhance our operations and effectively serve our customers. | ||

|

|

|

|

See the section entitled “Security Ownership of Management,” which begins on page 10,17, for information pertaining to stock ownership of our directors. There are no family relationships among any of the directors or nominees or any of theour executive officers of the Company.officers. There are no arrangements or understandings between any director and any other person pursuant to which any director was or is to be selected as a director.

The following chart displays information about the skills and experience of our directors. Most of our directors at least have exposure in each of these areas and many are proficient, but the chart below reflects only those that have self-reported as being from experienced to highly experienced in these areas.

Directors Self-Reporting as Being Experienced to Highly Experienced | |||||||||||||||||||||||

Experience operating a business line: | 10 | ||||||||||||||||||||||

Strategic planning experience: | 10 | ||||||||||||||||||||||

Experience serving on a public company board: | 10 | ||||||||||||||||||||||

Corporate governance experience: | 10 | ||||||||||||||||||||||

Risk management experience: | 10 | ||||||||||||||||||||||

Finance/accounting experience: | 10 | ||||||||||||||||||||||

Experience serving in a CEO/top officer role: | 9 | ||||||||||||||||||||||

Regulatory/governmental experience: | 9 | ||||||||||||||||||||||

Real estate industry experience: | 9 | ||||||||||||||||||||||

Customer experience/sales management experience: | 8 | ||||||||||||||||||||||

Title industry experience: | 8 | ||||||||||||||||||||||

Sustainability/ESG experience: | 8 | ||||||||||||||||||||||

Marketing experience: | 8 | ||||||||||||||||||||||

Investment management experience: | 7 | ||||||||||||||||||||||

Data industry experience: | 7 | ||||||||||||||||||||||

Insurance industry experience: | 7 | ||||||||||||||||||||||

Information technology experience: | 7 | ||||||||||||||||||||||

Human resource management experience: | 7 | ||||||||||||||||||||||

Information security experience: | 6 | ||||||||||||||||||||||

Experience operating a business line outside of the United States: | 5 |

6 | 2022 Proxy Statement First American Financial Corporation 2018 Proxy Statement | 5

I. Proposals |

Item 1. Election of Class IIIII Directors

Our certificate of incorporation provides for a classified Board. Each person elected as a Class IIIII director at the annual meeting of stockholders will serve for a three-year term expiring on the date of the 20212025 annual meeting and until his or her successor in office is elected and qualified. Our Board has nominated the following individuals for election as Class IIIII directors:

Dennis J. GilmoreReginald H. Gilyard

Margaret M. McCarthyParker S. Kennedy

Mark C. Oman

Unless otherwise specified by you in your proxy card, the proxies solicited by our Board will be voted “FOR” the election of each of the Class IIIII director nominees. If any nominee should become unable or unwilling to serve as a director, the proxies will be voted for such substitute nominee(s) as shall be designated by our Board. Our Board presently has no knowledge that any of the nominees will be unable or unwilling to serve.

6 | 2018 Proxy Statement First American Financial Corporation 2022 Proxy Statement | 7

I. Proposals |

Item 2. Advisory Vote to Approve Executive Compensation

Pursuant to Section 14A of the Securities Exchange Act of 1934 and Securities and Exchange Commission (“SEC”) rules, we are seeking the advice of our stockholders on the compensation of our named executive officers as presented in the “Executive Compensation” section of this proxy statement commencing on page 18.26. Specifically, we are seeking stockholder approval of the following resolution:

“RESOLVED, that the stockholders of First American Financial Corporation approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the Compensation Discussion and Analysis, the 2017 Summary Compensation Table and the related compensation tables, notes and narrative in the Proxy Statement for the Company’s 20182022 annual meeting of stockholders.”

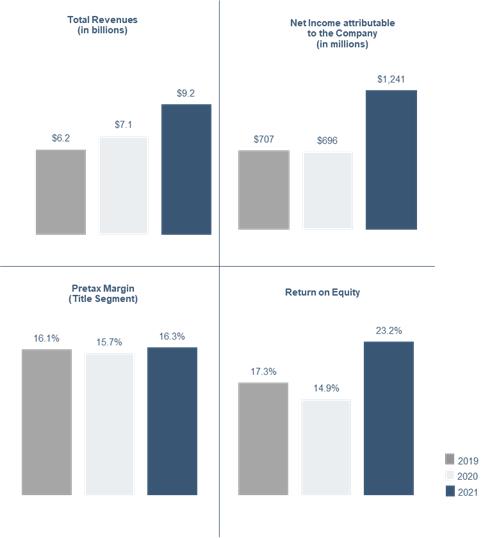

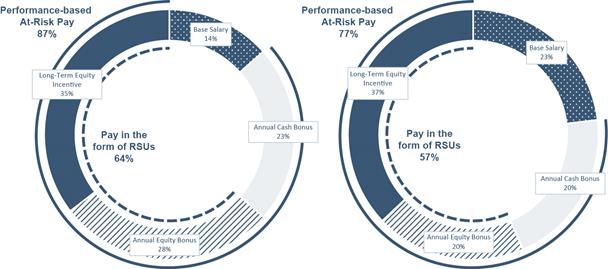

We refer to this proposal as a “Say on Pay” proposal. As part of its process in determining executive compensation levels for 2017,2021, the Compensation Committee has reviewed the results of last year’s Say on Pay proposal, in which approximately 97%68 percent of theour Company’s shares present and entitled to vote approved 20162020 executive compensation. The stockholder support for the prior Say on Pay proposal reinforces the Compensation Committee’s belief that it should continue its practice of implementing and overseeing executive compensation programs that provide for a substantial portion of the executive officer’sofficers’ total compensation to be related to theour Company’s consolidated financial performance. It also reinforces the Compensation Committee’s senseview that, for executive officers, the mix of compensation should be weighted heavily toward at-risk pay in particular, the annual incentive bonus (a portion of which consists of equity vesting over four years) and should include a substantial portion ofpayable in equity. This is consistent with the overall philosophy of maintaining a pay mix that results fundamentally in a pay-for-performance orientation and a strong alignment between the interests of executive officers and long-term stockholders.

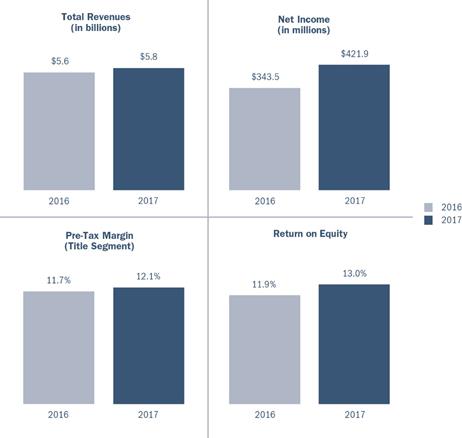

TheTo ensure that our compensation program aligns with the long-term interests of our stockholders, we engaged with our stockholders to seek feedback on our executive compensation program. We reached out to stockholders representing approximately 67 percent of our outstanding shares. Holders of approximately 58 percent of our outstanding shares responded to our outreach and approximately 49 percent chose to actively engage with us. Following a thorough review of our executive compensation program and incorporating feedback received from our stockholders, the Compensation Committee believesmade several important changes to our compensation program, including the Company’s management team achieved excellent results in 2017 and was successful in executingshift of 25 percent of long-term incentive awards for executive officers to multi-year performance awards based on the Company’s strategic objectives. The Company’s 2017 performance generally improved over a strong 2016, with revenue growing 3.5% to $5.8 billion and net income increasing from $343 million to $422 million. Pretax margin for the title insurance and services segment was 12.1%, the highest in the Company’s history and up 40 basis points over the prior year. Return on equity improved from 11.9% in 2016 to 13.0% in 2017. Both metrics, pretax margin and return on equity, met the Company’s stated long-term objectives. Reflecting its commitment to drive return for its stockholders, during the year the Company increased its cash dividend by 12% from an annual rate of $1.36 to $1.52 per share and achieved a one-year total stockholder return relative to the S&P MidCap 400® Index over a three-year period. With these changes, our compensation program places an even greater emphasis on objective performance metrics that we believe will drive long-term stockholder value. For example, 62 percent of 57.9%.

Duringall restricted stock units (“RSUs”) awarded in 2022 (in connection with 2021 performance) to our chief executive officer (who is now our chairman) were metric-based, and 59 percent, on average, of RSUs granted to our other named executive officers were metric-based, up from 44 percent and 36 percent, respectively, for the year the Company successfully executed against its long-term strategic goals. Though market share in its United States title insurance business decreased slightly, the Company completed a number of strategic acquisitions designed to grow and strengthen the Company’s core title and settlement business over the long-term. The Company also invested heavily in technology aimed at increasing the efficiency of its operations, reducing risk and enhancing the customer experience. As a complement to its technology investments, the Company also invested heavily in its real property databases, already the most comprehensive of their kind in the United States.prior year.

The full results of the 20172021 executive compensation program are included in the section entitled “Compensation Discussion and Analysis” below commencing on page 18.26. Stockholders are urged to read the Compensation Discussion and Analysis as well as the 2017 Summary Compensation Table and related compensation tables and narrative, appearing on pages 4156 through 52,66, in their entirety.

8 | 2022 Proxy Statement First American Financial Corporation 2018 Proxy Statement | 7

|

While this vote to approve executive compensation is not binding, the Compensation Committee intends to review the results of the vote in connection with its ongoing analysis of theour Company’s compensation programs. The Company expectsWe expect to include a Say on Pay proposal in itsour proxy materials on an annual basis and, thus, we expect that the next Say on Pay proposal will occur at the Company’s 2019our 2023 annual meeting.

8First American Financial Corporation 2022 Proxy Statement | 20189

I. Proposals |

Item 3. Approval of Amendment and Restatement of the 2010 Employee Stock Purchase Plan

On March 9, 2022, the Board adopted and approved the First American Financial Corporation 2010 Employee Stock Purchase Plan, As Amended and Restated effective July 1, 2022 (the “Amended ESPP”), subject to stockholder approval, as an amendment and restatement of the First American Financial Corporation 2010 Employee Stock Purchase Plan, As Amended and Restated effective July 1, 2013 (the “ESPP”). The Board is submitting the Amended ESPP to stockholders for adoption and approval at the 2022 annual meeting. The purpose of the Amended ESPP is to provide an opportunity for employees of our Company (and any participating subsidiaries) to purchase common stock of our Company at a discount through accumulated payroll deductions. The Amended ESPP is intended to qualify as an “employee stock purchase plan” under Section 423 of the Internal Revenue Code of 1986, as amended (the “Code”). However, sub-plans that do not meet the requirements of Section 423 of the Code may be established for the benefit of eligible employees of non-U.S. subsidiaries of our Company.

Summary of the Amended ESPP

The following is a summary of the principal features of the Amended ESPP. The following summary does not purport to be a complete description of all provisions of the Amended ESPP and is qualified in its entirety by the complete text of the Amended ESPP, which is attached to this proxy statement as Appendix B.

The Amended ESPP increases the maximum number of shares of Company common stock that will be made available for sale from 5,000,000 to 14,000,000. As of the record date, March 17, 2022, 576,364 shares remained available for issuance under the ESPP, which, together with the additional 9,000,000 shares, represents 8.8% of our common stock outstanding as of the record date. Additionally, the Amended ESPP extends the term from July 1, 2023 to July 1, 2032. Stockholder approval is required for each of these amendments. The Board believes that the Amended ESPP will encourage additional employee stock ownership and thereby better align the interests of employees with long-term stockholders. Stockholders are urged to read the Amended ESPP in its entirety.

Administration

An administrative benefits plan committee consisting of Company employees (the “Administrative Plan Committee”) administers the Amended ESPP. The Administrative Plan Committee has full discretionary authority to construe, interpret and apply the terms of the Amended ESPP, to determine eligibility and to adjudicate any disputed claims filed under the Amended ESPP. Any rights or responsibilities given to the Administrative Plan Committee under the Amended ESPP may be exercised by the Board, and the Administrative Plan Committee may delegate the routine day-to-day administration of the Amended ESPP to other persons or organizations, including to any employee of our Company.

Eligibility

All employees who are at least 18 years of age and employed by our Company or any participating subsidiaries of our Company will generally be eligible to participate in the Amended ESPP; however, the Administrative Plan Committee may exclude employees whose customary employment is for not more than 20 hours per week and/or five months in any calendar year. In addition, the Administrative Plan Committee may exclude employees who are citizens or residents of a foreign jurisdiction if the grant of an option to such an employee is prohibited under the laws of the foreign jurisdiction or if compliance with the laws of the foreign jurisdiction would cause the Amended ESPP to violate the provisions of Section 423 of the Code.

10 | 2022 Proxy Statement First American Financial Corporation

I. Proposals |

As of March 17, 2022, approximately 15,700 employees of our Company and our subsidiaries were eligible to participate in the Amended ESPP.

Offering Periods

The Amended ESPP currently operates in consecutive quarterly periods referred to as “offering periods.” The Board, the Administrative Plan Committee and our Company’s chief executive officer may change the duration (including the commencement date) of future offering periods without stockholder approval. However, offering periods may not last longer than the maximum offering period permitted under Section 423 of the Code.

Purchase Price

The purchase price for each option will equal 85% of the lesser of the fair market value of a share of our Company’s common stock (i) on the first day of the offering period or (ii) on the last day of the offering period (such date, the “Exercise Date’). The Board, the Administrative Plan Committee or our Company’s chief executive officer may, prior to the start of any offering period, provide that the purchase price for each option will equal a different amount that is no less than 85% of the fair market value of a share of our Company’s common stock on either the first or last day of the offering period.

Payroll Deductions

A participant must designate in his or her enrollment package the amount (if any) of compensation to be deducted during that offering period for the purchase of stock under the Amended ESPP. Unless otherwise determined by the Administrative Plan Committee, this election may be decreased during the offering period, subject to any limitations on the number of changes determined by the Administrative Plan Committee, and will continue in effect for future offering periods unless terminated (or increased or decreased) by the participant. Each participant’s payroll deductions under the Amended ESPP will be credited to a bookkeeping account in his or her name under the Amended ESPP. Amounts contributed to the Amended ESPP constitute general corporate assets of our Company and may be used for any corporate purpose.

Purchase of Stock

A participant properly enrolled in the Amended ESPP for an offering period will be granted an option to purchase shares of our Company’s common stock. Each participant’s option will permit the participant to purchase a number of shares determined by dividing the employee’s accumulated payroll deductions for the offering period by the applicable purchase price. Unless a participant withdraws from the Amended ESPP, each option granted under the Amended ESPP will automatically be exercised on the Exercise Date, and the number of shares acquired by a participant will be determined by dividing the participant’s Amended ESPP account balance as of the Exercise Date for the offering period by the purchase price of the option.

Withdrawal

A participant may also elect to withdraw from any offering period on or before a date designated by the Administrative Plan Committee, in which case the participant’s payroll deductions will be refunded and the participant’s outstanding options will terminate.

Limits on Authorized Shares; Limits on Contributions

If our Company’s stockholders approve the Amended ESPP, the maximum number of shares of our Company’s common stock that may be purchased will increase from 5,000,000 to 14,000,000 (subject to adjustment as described below).

First American Financial Corporation 2022 Proxy Statement | 11

I. Proposals |

Participation in the Amended ESPP is also subject to the following limits:

A participant will not be granted an option under the Amended ESPP if it would cause the participant to own stock and/or hold outstanding options to purchase stock possessing 5% or more of the total combined voting power or value of all classes of stock of our Company or one of our subsidiaries.

A participant cannot accrue rights to purchase more than $25,000 of stock (determined at the fair market value of the shares at the time such option is granted) for each calendar year in which an option is outstanding.

A participant’s payroll contributions are limited to 15% of his or her compensation and $7,000 per offering period (or such other percentage or amount specified by the Board, the Administrative Plan Committee or our Company’s chief executive officer).

•A participant cannot purchase more than 1,000 shares of our Company’s common stock under the Amended ESPP with respect to any one offering period (or such other share limit specified by the Board, the Administrative Plan Committee or our Company’s chief executive officer). |

Termination of Employment

If a participant ceases to be an eligible employee for any reason, such participant will immediately and automatically be removed from the Amended ESPP. As such, the participant’s payroll deductions will automatically cease, the participant’s payroll deductions will be refunded, and the participant’s outstanding options will terminate.

Corporate Transactions

Upon the occurrence of a sale of all or substantially all the business, stock or assets of our Company or any merger, combination, consolidation, exchange or other reorganization or similar event in connection with which our Company does not survive (or does not survive as a public company in respect of our common stock), the Board or Administrative Plan Committee may make provision for the assumption, substitution, or exchange of the outstanding options based upon, to the extent relevant, the distribution or consideration payable to holders of the common stock upon or in respect of such event. If the Board or Administrative Plan Committee fails to make such a provision or if the outstanding options would otherwise not continue in accordance with their terms, then the in-progress offering period will be shortened by establishing a new Exercise Date that is before the date of the corporate transaction.

Liquidation or Dissolution

If our Company proposes to dissolve or liquidate, unless otherwise provided by the Board or the Administrative Plan Committee, the then in-progress offering period will be shortened by establishing a new Exercise Date that is before the date of the liquidation or dissolution.

Adjustments

The number and type of shares of stock available under the Amended ESPP or subject to outstanding options, as well as the purchase price of outstanding options and the share limits under the Amended ESPP, are subject to adjustment in the event of certain reclassifications, reorganizations, mergers, consolidation, combinations, recapitalizations, spin-offs, stock splits, stock dividends, extraordinary dividends or distributions of property to the stockholders or any similar unusual or extraordinary corporate transaction in respect of our Company’s common stock.

12 | 2022 Proxy Statement First American Financial Corporation

I. Proposals |

A participant’s rights with respect to options or the purchase of shares under the Amended ESPP, as well as payroll deductions credited to his or her Amended ESPP account, may not be assigned, transferred, pledged or otherwise disposed of in any way except by will or the laws of descent and distribution.

Amendments

The Board or the Administrative Plan Committee generally may amend, suspend, or terminate the Amended ESPP at any time and in any manner, provided that, with limited exceptions, the action may not adversely affect a participant’s rights under his or her outstanding options. Stockholder approval for an amendment to the Amended ESPP will generally only be required to the extent necessary to meet the requirements of Section 423 of the Code or to the extent otherwise required by law or applicable stock exchange rules.

Subplans

The Board or the Administrative Plan Committee may adopt subplans applicable to particular subsidiaries of our Company, which may be designed to be outside the scope of Section 423 of the Code.

Term

The ESPP originally became effective on May 28, 2010 and was amended and restated effective July 1, 2013. Subject to stockholder approval, the Amended ESPP will become effective on July 1, 2022 and the Amended ESPP will continue in effect for a term of 10 years (until July 1, 2032), unless terminated earlier by the Board or its delegate.

U.S. Federal Income Tax Consequences

The rules concerning the federal income tax consequences with respect to the purchase of shares under the Amended ESPP are quite technical. Moreover, the applicable statutory provisions are subject to change, as are their interpretations and applications, which may vary in individual circumstances. Therefore, the following is designed to provide a general summary of the current U.S. federal income tax principles applicable to the Amended ESPP. The following summary is not intended to be exhaustive and, among other considerations, does not describe the deferred compensation provisions of Section 409A of the Code to the extent an award is subject to and does not satisfy those rules, nor does it describe gift, estate, social security, state, local or international tax consequences. In addition, if one or more sub-plans are established for employees of non-U.S. subsidiaries, the tax rules may be different than discussed below.

The Amended ESPP is intended to qualify as an “employee stock purchase plan” under Section 423 of the Code. Participant contributions to the Amended ESPP through payroll deductions are made on an after-tax basis. That is, a participant’s payroll deductions that are contributed to the Amended ESPP are deducted from compensation that is taxable to the participant and for which our Company is generally entitled to a tax deduction.

Generally, no taxable income is recognized by a participant with respect to either the grant or exercise of his or her Amended ESPP option. Our Company will have no tax deduction with respect to either of those events. A participant will generally recognize income (or loss) only upon a sale or disposition of any shares that the participant acquires under the Amended ESPP. The particular tax consequences of a sale or disposition of shares acquired under the Amended ESPP depend on whether the participant has held the shares for a “Required Holding Period” before selling or disposing of the shares. The Required Holding Period ends on the later of (i) two years after the first day of the offering period in which the

First American Financial Corporation 2022 Proxy Statement | 13

I. Proposals |

participant acquired the shares, or (ii) one year after the Exercise Date on which the participant acquired the shares.

If the participant holds the shares for the Required Holding Period and then sells the shares at a price in excess of the purchase price paid for the shares, the gain on the sale of the shares will be taxed as ordinary income to the participant to the extent of the lesser of (i) the amount by which the fair market value of the shares on the first day of the offering period in which the participant acquired the shares exceeded the purchase price of the shares (calculated as though the shares had been purchased on the first day of the offering period), or (ii) the gain on the sale of the shares. Any portion of the participant’s gain on the sale of the shares not taxed as ordinary income will be taxed as long-term capital gain. If the participant holds the shares for the Required Holding Period and then sells the shares at a price less than the purchase price paid for the shares, the loss on the sale will be treated as a long-term capital loss to the participant. Our Company will not be entitled to a tax deduction with respect to any shares held by the participant for the Required Holding Period, regardless of whether the shares are eventually sold at a gain or a loss.

The participant has a “Disqualifying Disposition” for tax purposes if the participant disposes of the shares before the participant has held the shares for the Required Holding Period. If the participant sells the shares in a Disqualifying Disposition, regardless of whether the shares are sold at a gain or a loss, the participant will realize ordinary income in an amount equal to the difference between the purchase price paid for the shares and the fair market value of the shares on the Exercise Date on which the participant acquired the shares, and our Company generally will be entitled to a corresponding tax deduction. In addition, if the participant makes a Disqualifying Disposition of the shares at a price in excess of the fair market value of the shares on the Exercise Date, the participant will realize capital gain in an amount equal to the difference between the selling price of the shares and the fair market value of the shares on the Exercise Date. Alternatively, if the participant makes a Disqualifying Disposition of the shares at a price less than the fair market value of the shares on the Exercise Date, the participant will realize a capital loss in an amount equal to the difference between the fair market value of the shares on the Exercise Date and the selling price of the shares. Our Company will not be entitled to a tax deduction with respect to any capital gain realized by a participant.

Specific Benefits Under the Amended ESPP

The benefits that will be received by or allocated to eligible employees under the Amended ESPP cannot be determined at this time because the amount of payroll deductions contributed to purchase shares of our Company’s common stock under the Amended ESPP (subject to the limitations discussed above) is entirely within the discretion of each participant.

The following table sets forth the number of shares purchased under the ESPP from 2010 (the year in which the ESPP was first adopted) through 2021 by our named executive officers and the specified groups set forth below.

14 | 2022 Proxy Statement First American Financial Corporation

I. Proposals |

Purchases Under ESPP | ||||||

Name | Dollar Value ($) | Number of Shares | ||||

Named Executive Officers |

|

|

|

|

|

|

Dennis J. Gilmore, Chief Executive Officer through February 4, 2022, when he became Chairman of the Board of Directors |

| — |

|

| — |

|

Kenneth D. DeGiorgio, President through February 4, 2022, when he became Chief Executive Officer |

| — |

|

| — |

|

Christopher M. Leavell, Chief Operating Officer, First American Title Insurance Company |

| — |

|

| — |

|

Mark E. Seaton, Executive Vice President, Chief Financial Officer |

| — |

|

| — |

|

Matthew F. Wajner, Vice President, Treasurer |

| — |

|

| — |

|

All current executive officers as a group |

| $92,377 |

|

| 2,630 |

|

All current non-employee directors as a group |

| — |

|

| — |

|

Each nominee for election as a director |

| — |

|

| — |

|

Each associate of the above-mentioned executive officers, directors and director nominees |

| — |

|

| — |

|

Each other person who received or is to receive 5% of such options, warrants or rights |

| — |

|

| — |

|

All employees, including all current officers who are not executive officers, as a group |

| $139,669,333 |

|

| 4,421,006 |

|

The closing price of a share of our Company’s common stock as of March 17, 2022, was $68.32 per share.

We intend to file with the U.S. Securities and Exchange Commission, after our stockholders approve the Amended ESPP, a registration statement on Form S-8 covering the new shares reserved for issuance under the ESPP.

Please refer to the Securities Authorized for Issuance under Equity Compensation Plans table on page 70 for details regarding equity securities of our Company that were authorized for issuance under equity compensation plans of our Company as of December 31, 2021.

First American Financial Corporation 2022 Proxy Statement | 15

I. Proposals |

Item 3.4. Ratification of Selection of Independent Auditor

The Audit Committee has selected PricewaterhouseCoopers LLP (“PwC”) to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2018.2022. Representatives of PwC are expected to be present atparticipate in the annual meeting, and, if they do attendparticipate in the annual meeting, will have an opportunity to make a statement and be available to respond to appropriate questions.

Selection of our independent registered public accounting firm is not required to be submitted for stockholder approval, but the Audit Committee is seeking ratification of its selection of PwC from our stockholders as a matter of good corporate governance. If the stockholders do not ratify this selection, the Audit Committee will reconsider its selection of PwC and will either continue to retain this firm or appoint a new independent registered public accounting firm. Even if the selection is ratified, the Audit Committee may, in its discretion, appoint a different independent registered public accounting firm at any time during the year if it determines that such a change would be in our Company’s best interests and those of itsour stockholders.

16 | 2022 Proxy Statement First American Financial Corporation 2018 Proxy Statement | 9

II. Required Information |

Security OwnershipOwnership of Management

The following table sets forth the total number of our shares of common stock beneficially owned and the percentage of the outstanding shares so owned as of the record date by:

each director (and each nominee for director);,

each executive officer named in the “2017 Summary“Summary Compensation Table” on page 4156 (each, a “named executive officer”);, and

all current directors and executive officers as a group.

Unless otherwise indicated in the notes following the table, the stockholders listed in the table are the beneficial owners of the listed shares with sole voting and investment power (or, in the case of individual stockholders, shared power with such individual’s spouse) over the shares listed. Shares subject to rights exercisable within 60 days after the record date are treated as outstanding when determining the amount and percentage beneficially owned by a personowned. None of the directors or entity.officers included in the table below have the right to acquire any shares within 60 days of the record date.

Stockholders | Number of Common Shares | Percent if greater than 1% | Number of Common Shares | Percent if greater than 1% | ||||||||

Directors |

|

|

|

|

|

|

|

|

|

|

|

|

Kenneth D. DeGiorgio |

| 110,104 |

|

| — |

| ||||||

James L. Doti |

| 49,714 |

|

| — |

|

| 66,559 |

|

| — |

|

Dennis J. Gilmore |

| 292,007 |

|

| — |

|

| 468,090 |

|

| — |

|

Reginald H. Gilyard |

| — |

|

| — |

|

| 10,513 |

|

| — |

|

Parker S. Kennedy(1) |

| 2,649,799 |

|

| 2.4% |

| ||||||

Parker S. Kennedy |

| 2,632,670 | (1) |

| 2.4% |

| ||||||

Margaret M. McCarthy |

| 10,817 |

|

| — |

|

| 18,411 |

|

| — |

|

Michael D. McKee |

| 30,847 |

|

| — |

|

| 43,515 |

|

| — |

|

Thomas V. McKernan |

| 40,847 |

|

| — |

|

| 50,805 |

|

| — |

|

Mark C. Oman |

| 26,888 |

|

| — |

|

| 40,846 |

|

| — |

|

Virginia M. Ueberroth(2) |

| 144,523 |

|

| — |

| ||||||

Martha B. Wyrsch |

| 8,558 |

|

| — |

| ||||||

Named executive officers who are not directors |

|

|

|

|

|

|

|

|

|

|

|

|

Kenneth D. DeGiorgio |

| 13,999 |

|

| — |

| ||||||

Christopher M. Leavell |

| 71,157 |

|

| — |

|

| 92,794 |

|

| — |

|

Mark E. Seaton |

| 30,526 |

|

| — |

|

| 95,290 |

|

| — |

|

Matthew F. Wajner |

| 9,978 |

|

| — |

|

| 17,371 |

|

| — |

|

All directors, named executive officers and other executive officers as a group (13 persons) |

| 3,371,103 |

|

| 3.0% |

| ||||||

All directors, named executive officers and other executive officers as a group (15 persons) |

| 3,659,280 |

|

| 3.4% |

| ||||||

(1) | Includes 2,466,686 shares held by Kennedy Enterprises, L.P., a California limited partnership of which Mr. Kennedy is the sole general partner. The limited partnership agreement pursuant to which the partnership was formed provides that the general partner has all powers of a general partner as provided in the California Uniform Limited Partnership Act, including the power to vote securities held by the partnership, provided that the general partner is not permitted to cause the partnership to sell, exchange or hypothecate any of its shares of stock of the Company without the prior written consent of all of the limited partners. Except to the extent of his voting power over the shares allocated to the capital accounts of the limited partners, Mr. Kennedy disclaims beneficial ownership of all shares held by the partnership other than those allocated to his own and his wife’s capital accounts. | |

|

|

10 | 2018 Proxy Statement First American Financial Corporation

|

None of the directors or officers included in the table above have the right to acquire any shares within 60 days of the record date.

Our Board held fivesix meetings during 2017.2021. No incumbent director attended less than 75% of the aggregate of all meetings of the Board and the committees (if any) on which the director served. From time to time, our Board may act by unanimous written consent as permitted by the laws of the State of Delaware. Our Board’s standing committees include an audit, nominating and corporate governance,

First American Financial Corporation 2022 Proxy Statement | 17

II. Required Information |

compensation and compensationexecutive committee. Our Board also has an ad-hoc information security risk oversight, accountability and review committee (“ROAR committee”). The following table reflects the composition of each of the standing committees as of the date of this proxy statement.

| Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Executive Committee | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Executive Committee | ||||||||||||||||

Number of Meetings in 2017 |

| 6 |

|

| 6 |

|

| 5 |

|

| 1 |

| ||||||||||||

Number of Meetings in 2021 |

| 7 |

|

| 5 |

|

| 3 |

|

| 1 |

| ||||||||||||

Independent Directors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

Dr. James L. Doti | o |

|

|

|

|

|

|

|

|

|

|

| o |

|

|

|

|

|

|

|

|

|

|

|

Reginald H. Gilyard |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Parker S. Kennedy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Margaret M. McCarthy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael D. McKee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thomas V. McKernan |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark C. Oman |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Virginia M. Ueberroth |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

Martha B. Wyrsch |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

Inside Directors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

Kenneth D. DeGiorgio |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

Dennis J. Gilmore |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Audit Committee

The members offunctions performed by the Audit Committee are Messrs. Doti (chair), McKernan and Oman. The functions performed by this committee include:

reviewing internal auditing procedures, plans, results, resources and results;budgets;

selecting our independent registered public accounting firm;

engaging with our compliance and risk management executives to review the state of enterprise risk management and compliance programs with a view to understanding the steps management has taken to monitor and control the Company’s major risk exposures;

serving as the Board’s designated risk oversight committee (see the Risk Oversight section beginning on page 1422 for additional details);

engaging with our compliance and risk management executives to review the state of enterprise compliance programs and risk management with a view to understanding the steps management has taken to monitor and control our Company’s major risk exposures;

reviewing with internal counsel the state of litigation, claims and regulatory matters;

discussing with management, internal audit and external advisors the state of internal controls and management tone;

directing and supervising investigations into matters within the scope of its duties;

reviewing with the independent registered public accounting firm the plan and results of its audit and determining the nature of other services to be performed by, and fees to be paid to, such firm;

reviewing our Company’s information technology and information security functions; and

supervising the oversight of our Company’s investment portfolios.

18 | 2022 Proxy Statement First American Financial Corporation 2018 Proxy Statement | 11

II. Required Information |

supervising the oversight of the Company’s investment portfolios.

The Audit Committee’s charter is posted in the corporate governance section of our Web sitewebsite at www.firstam.com. Our Board of Directors has determined that Messrs. Doti, McKernan and Oman are audit committee financial experts within the meaning of the SEC’s rules and regulations and that each member of the Audit Committee meets the requirement of independence established in the Securities Exchange Act of 1934, as amended, and the New York Stock Exchange listing standards.regulations.

Compensation Committee

The members of the Compensation Committee are Messrs. Kennedy, McKee (chair) and Oman. This committee establishes compensation rates and procedures with respect to our executive officers, including the determination of their annual bonus awards, monitors our equity compensation plans, assesses risk with respect to our compensation programs and makes recommendations to the Board regarding director compensation. The Compensation Committee’s charter is posted in the corporate governance section of our Web sitewebsite at www.firstam.com.

Additional information concerning the Compensation Committee’s processes and procedures surrounding non-employee director compensation is included in the section entitled “2017 Director“Director Compensation,” which begins on page 53.67. Additional information concerning the executive compensation policies and objectives established by the Compensation Committee, the Compensation Committee’s processes and procedures for consideration and determination of executive compensation, and the role of executive officers and the Compensation Committee’s compensation consultant in determining executive compensation is included in the section entitled “Compensation Discussion and Analysis,” which begins on page 18,26, under the subsection entitled “Compensation Decision Process,” which begins on page 25.38.

Nominating and Corporate Governance Committee

The members of the Nominating and Corporate Governance Committee are Mses. McCarthy and Ueberroth (chair) and Mr. Gilyard. This committee is responsible for identifying individuals qualified to become directors of our Company; recommending thatto the Board select the nominees identified by this committee for all directorships to be filled by the Board or by the stockholders; and developing, recommending to the Board and periodically reviewing the corporate governance principles applicable to our Company.Company; overseeing our Company’s succession plan for the chief executive officer and the succession planning process for other key employees; and overseeing sustainability matters material to our Company’s business. This committee’s charter is posted in the corporate governance section of our Web sitewebsite at www.firstam.com. The committee has adoptedcommittee’s charter outlines the procedures by which certain stockholders of theour Company may recommend director nominees to the Board. In particular, the committee has established a policy whereby it will accept and consider, in its discretion, director recommendations from any stockholder holding in excess of five percent of theour Company’s outstanding shares of common stock. Such recommendations must include the name and credentials of the recommended nominee and should be submitted to the secretary of theour Company at our address indicated on the first page of this proxy statement.1 First American Way, Santa Ana, California 92707. The committee will evaluate director candidates recommended by stockholders for election to our Board in the same manner and using the same criteria as used for any other director candidate (as described below). If the committee determines that a stockholder-recommended candidate is suitable for membership on our Board, it will include the candidate in the pool of candidates to be considered for nomination upon the occurrence of the next vacancy on our Board or in connection with the next annual meeting of stockholders.

Our Bylaws also provide for proxy-access, which is described in the section “Stockholder Proposals, Director Nominations and Proxy Access” on page 71. In 2022, in response to stockholder feedback, we amended our Bylaws to implement majority voting in uncontested elections of directors. In contested elections, where the number of nominees exceeds the number of directors to be elected, plurality voting will continue to apply. Our Bylaws also require that any director who does not receive a majority of the votes cast will promptly tender his or her resignation for consideration by the Nominating and Corporate Governance Committee and the Board.

12 | 2018 Proxy Statement

First American Financial Corporation 2022 Proxy Statement | 19

II. Required Information |

As stated in its charter, while the committee has no specific minimum qualifications in evaluating a director candidate,corporate governance guidelines, the committee takes into account all factors it considers appropriate in identifying and evaluating candidates for membership on the Board, including some or all of the following: strength of character, an inquiring and independent mind, practical wisdom, mature judgment, career specialization, relevant technical skills, reputation in the community, diversity and the extent to which the candidate would fill a present need on the Board. This committee makes recommendations to the full Board as to whether or not incumbent directors should stand for re-election. However, if theour Company is legally required by contract or otherwise to provide third parties with the ability to nominate directors, the selection and nomination of such directors generally is not subject to the committee process for identifying and evaluating nominees for director. The committee conducts all necessary and appropriate inquiries into the background and qualifications of possible candidates and may engage a search firm to assist in identifying and evaluating potential candidates for nomination.

The Company does not haveOur corporate governance guidelines set forth a formal policy for the consideration of diversity in identifying nominees for director. However, the Nominating and Corporate Governance CommitteeThe policy recognizes the benefits associated with a diverse board and, as indicated above, considersrequires that the Nominating and Corporate Governance Committee consider diversity as a factor when identifying and evaluating candidates for membership on the Board. The committeepolicy utilizes a broad conception of diversity, including professional and educational background, prior experience on other boards, of directors (both public and private), political and social perspectives, as well as race, national origin, gender and sexual orientation. The Nominating and Corporate Governance Committee assessed the effectiveness of the Board diversity policy by considering, among other factors, self-assessed director skills and experience; the race, national origin. origin, gender and sexual orientation of Board members; and the practices of the Board and the committee when identifying and evaluating candidates for membership on the Board. The California corporations code required us to have three or more female directors and at least one director from an underrepresented community at some point during 2021. During 2021, we had the minimum number of female directors and directors from underrepresented communities necessary to comply with California law.

Utilizing thesethe factors and in recognition of the factorslegal requirements described above, the committee makes recommendations, as it deems appropriate, regarding the composition and size of the Board. The priorities and emphasis of the committee and of the Board may change from time to time to take into account changes in business and other trends and the portfolio of skills and experience of current and prospective Board members.

In 2016, the Board adopted a Bylaw to permit a stockholder, or group of up to 20 stockholders, owning at least 3% of the Company’s issued and outstanding stock entitled to vote generally in the election of directors continuously for at least three years, to nominate and include in the Company’s proxy materials for an annual meeting of stockholders, director nominees constituting up to 20% of the Board, provided that the stockholder(s) and the director nominee(s) satisfy the requirements specified in the Bylaws.

Our corporate governance guidelines also contain a mandatory retirement policy, which provides that no person is eligible for election as a director if on January 1 of the year of the election he or she is age 77 or older. The Board has not granted any waivers or exemptions to this policy.

The Board has affirmatively determined that each member of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee, as well as each other member of the Board, except Kenneth D. DeGiorgio and Dennis J. Gilmore, (who is not independent), is “independent” as that term is defined in the corporate governance rules of the New York Stock Exchange for listed companies and thatin accordance with our Company’s corporate governance guidelines. In addition, each member of the Audit Committee and the Compensation Committee is independent under the additional standards applicable to the respective committee.committee under the Securities Exchange Act of 1934, as amended, and the New York Stock Exchange listing standards. In making these determinations, the Board considered the following relationships between directors and theour Company: Mr.Messrs. Gilyard and McKee and Ms. McCarthy are affiliated with, and Mr. Oman wasMss. McCarthy and Wyrsch were previously affiliated with, entities that do business with, or that represent clients that do business with, the Companyus in the ordinary course from time to time;time (and the amounts involved in each case are significantly less than 2% of such entity’s consolidated gross revenues); each of Messrs.

20 | 2022 Proxy Statement First American Financial Corporation

II. Required Information |

Doti Gilyard,and Kennedy and McKernan and Ms. Ueberroth is or recently was affiliated with one or more nonprofit organizations to which theour Company and/or itsour management has made donations from time to time;time (and the amounts in each case are significantly less than $1 million and 2% of the nonprofit organization’s consolidated gross revenues); and Mr. Kennedy receives standard board fees for his service as a director of theour Company’s trust subsidiary, as further described in the section entitled “2017 Director“Director Compensation,” which begins on page 53.67. Each of the relationships above, while considered by the Board, falls within the Company’sour categorical independence standards contained in the Board’s corporate governance guidelines, which areavailable on

First American Financial Corporation 2018 Proxy Statement | 13

|

the corporate governance section of the Company’s Web siteour website at www.firstam.com. The Board also considered the following relationships between Mr. Kennedy and theour Company: he was employed by the Company as itsour executive chairman until his retirement in February 2012; for serving as chairman of the Board until February 9, 2022 and as lead independent director of the Board since then, he receives Company-provided office space, mobile devices, computer, other office equipment and secretarial assistanceadministrative support as set forth in the section entitled “2017 Director“Director Compensation,” which begins on page 53; he may from time to time attend certain subsidiary board meetings as well as certain meetings with management;67; and his son is employed by a subsidiary of theour Company as further described in the section entitled “Transactions and Litigation with Management and Others” on page 16.23.

Board Leadership Structure; Meetings of Independent Directors

Our Board believes it is important to select theour Company’s chairman and theour Company’s chief executive officer in the manner it considers in the best interests of theour Company at any given point in time. Accordingly, the chairman and chief executive officer positions may be filled by one individual or by two different individuals. Our Board has determined at this time that it is appropriate to separate the roles of chairman and chief executive officer and these positions are currently held by different individuals, Mr. Gilmore and Mr. DeGiorgio, respectively. During 2021, Mr. Kennedy served as our chairman and Mr. Gilmore respectively.as our chief executive officer.

In addition to a chairman, we also have a lead independent director, currently Mr. Doti.Kennedy. Dr. Doti served as our lead independent director during 2021. The lead director is responsible for chairing and coordinating the agenda for the executive sessions of independent directors or, as applicable, the non-management directors, which are those directors who are not employees of the Company.directors. In 20172021, the independent directors met fivefour times in executive session. In addition, the lead director is tomay provide advice to the chairman with respect to the following: (i) establishing an appropriate schedule for Board meetings; (ii) preparing agendas for the meetings of the Board and its committees; (iii) the retention of consultants who report directly to the Board; (iv) the Nominating and Corporate Governance Committee’s oversight and implementation of the Company’sour corporate governance policies; and (v) the Compensation Committee’s oversight of the implementation of and compliance with theour Company’s policies and procedures for evaluating and undertaking executive and incentive-based compensation.

Our Board believes this to be the most effective leadership structure for theour Company at this time because it effectively allocates authority, responsibility, and oversight between management, the chairman of the Board and the lead director and capitalizes on the experience and strengths of our current management team. It does this by giving primary responsibility for the operational leadership and strategic direction of theour Company to our chief executive officer, enabling the lead director to facilitate our Board’s independent oversight of management and consideration of key governance matters, and allowing our chairman to promote communication between management and our Board. The Board believes that its programs for overseeing risk, as described under the Risk Oversight section below, would be effective under a variety of leadership frameworks. Accordingly, the Board’s risk oversight function did not significantly impact its selection of the current leadership structure.

First American Financial Corporation 2022 Proxy Statement | 21

II. Required Information |

The Board and each of its committees conduct an annual self-evaluation to determine whether the Board and its committees are functioning effectively. In connection with this annual evaluation, directors are given an opportunity to evaluate the effectiveness of each other and to evaluate their own personal effectiveness. The results of the evaluation are reported to the Board and each committee.

The Board’s responsibilities in overseeing theour Company’s management and business to maximize long-term stockholder value include oversight of theour Company’s key risks and management’s processes and controls to manage those risks appropriately. Management, in turn, is responsible for the day-to-day management of risk and implementation of appropriate risk management controls and procedures.

Although risk oversight permeates many elements of the work of the full Board and the committees, the Audit Committee has the most direct and systematic responsibility for overseeing risk management and

14 | 2018 Proxy Statement First American Financial Corporation

|

has been designated by the Board as its risk oversight committee. To that end, the Audit Committee charter provides for a variety of regular and recurring responsibilities relating to risk, including:

having responsibility for the internal audit function, with that function reporting directly to the committee;

overseeing the independent registered public accounting firm;

receiving reports from management and the independent auditor regarding the adequacy and effectiveness of various internal controls;

reviewing regularly with management legal and regulatory matters that could have a significant impact on theour Company;

supervising the oversight of theour Company’s investment portfolios;

overseeing theour Company’s compliance program with respect to legal and regulatory requirements and risks; and

discussing with management and the independent auditor theour Company’s guidelines and policies with respect to risk assessment and risk management, including theour Company’s major risk exposures and the steps management has taken to monitor and control such exposures.

In performing these functions, the committee regularly receives reports from management including the Company’s enterprise risk management committee on which senior officers of the Company sit, and internal and external auditors regarding the Company’s our Company’s:

information technology environment and business continuity programs;

information security and cybersecurity programs;

enterprise risk management program, program;

compliance program, program;

investment portfolios, information securityportfolios;

vendor management program;

insurance program; and business continuity programs, extraordinary

litigation, claims and losses and noteworthy litigation.regulatory exposures.

22 | 2022 Proxy Statement First American Financial Corporation

II. Required Information |

Separately, the Compensation Committee oversees theour Company’s compensation policies and practices and has assessed whether theour Company’s compensation policies encourage excessive risk taking. The Compensation Committee has concluded that these policies and practices do not create risks that are reasonably likely to have a material adverse effect on theour Company. In arriving at that conclusion, the Compensation Committee considered, among other factors, theour Company’s review and approval processes surrounding certain compensatory arrangements; the metrics used to determine variable compensation, including the performance measures selected by the Compensation Committee and performance ranges associated with the metrics; the Compensation Committee’s oversight of inclusion or exclusion of extraordinary items in the financial results upon which certain compensatory arrangements are based; the inclusion of overall Company performance in the determination of divisional leader compensation; the portion of variable compensation paid in restricted stock units, which generally vest over three to four years; the extent to which qualitative judgments are involved in the compensatory arrangements; the amount of compensation paid as sales commissions, the numbermanagement’s review of people to whom such compensation is paid and the localized nature of the commission payments; controls, such as actuarial studies on claims, underwriting controls and quality checks that the Company employs;approval controls; and the extent to which compensatory arrangements can be changed if circumstances evidence increased risk associated with such arrangements.

As a supplement to the oversight of the Audit Committee of our Company’s information security program, the Board formed in 2019 the ROAR committee as an ad-hoc committee comprised of Ms. McCarthy (chair) and Mr. McKernan to oversee the implementation of certain information security-related recommendations, to provide Board-level feedback to management on information security matters and to drive accountability for information security.

Director Attendance at Annual Meetings